pa inheritance tax family exemption

Act 52 adds Section 2111t to the Pennsylvania Tax Reform Code to exempt the following transfers at death from PA inheritance tax. The spouse of any decedent dying domiciled in the Commonwealth and if there be no spouse or if he has forfeited his rights then such children.

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

All questions regarding your Inheritance Tax Return should be directed to the PA Department of Revenue.

. 0 Inheritances to a spouse. The most notable is that life insurance proceeds are not taxable. The family exemption There is a deduction for the family exemption up to 3500.

Farm Inheritance Tax 相続税 Pennsylvania. The family exemption is generally payable from the probate estate and in certain instances may be paid from the decedents trust. 45 percent on transfers to direct.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Also effective for estates of decedents dying after June 30 2012 there is a Pennsylvania inheritance tax exemption for transfers of real estate devoted to the business of. To qualify for the family-owned business exemption a.

Pennsylvania also allows a family exemption deduc-tion of 3500 paid to a member of the immediate family living with the. The tax rate for Pennsylvania Inheritance Tax is 45 percent for transfers to direct descendants lineal heirs 12 percent for transfers to siblings and 15 percent for transfers to other heirs. Pennsylvania has various exemptions from inheritance tax.

Claiming the family exemption for inheritance tax. Pennsylvania has an Inheritance Tax that applies in general to transfers resulting. Learn How EY Can Help.

There is a 12 tax on transfers to siblings and a 15 tax on transfers to any other heir with the exception of charitable organizations exempt institutions and government. The family exemption is 3500. What is the family exemption for inheritance tax.

The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or. The rates for Pennsylvania inheritance tax are as follows. The amount must be claimed by and paid to a surviving spouse if any or to child if any or to a.

Under a new Pennsylvania law there will no longer be an inheritance tax on farms owned by decedents who. Pennsylvania Inheritance Tax is currently 45 for linear descendants 12 for siblings and 15 for everyone else. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating.

Ad Estate Trust Tax Services. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Who is entitled to claim the family exemption for inheritance tax.

Ad Estate Trust Tax Services. March 10 2021. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural.

To understand the significance of this most recent change its helpful to review the history of Pennsylvanias inheritance tax law. Learn How EY Can Help. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

There is a flat 45 inheritance tax on most assets that pass up to your parents grandparents or your other lineal ascendants. Exception if the decedent is under age 21. 5 rows Pennsylvania Inheritance Tax.

Staples Provides Custom Solutions to Help Organizations Achieve their Goals. Family Owned Business Pennsylvania Tax Exemption The family owned business tax exemption can have a big impact on your Pennsylvania inheritence taxes. In addition transfers to charitable and fraternal.

Ad Shop a Wide Variety of Tax Forms from Top Brands at Staples. Pennsylvania Inheritance Tax Law Has New Exemption For Small Family Businesses. The Register of Wills Office is a filing office for your Tax return and.

1 A transfer of a qualified family-owned. Traditionally the Pennsylvania inheritance tax had a very. Where to file an inheritance tax return.

Are fully deductible for Pennsylvania Inheritance Tax purposes. Can closing costs and repairs from. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

Lets say that when you die your leave your home and investments to your.

Pennsylvania Tax Exemption For Family Owned Business

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kill The Inheritance Tax Pittsburgh Post Gazette

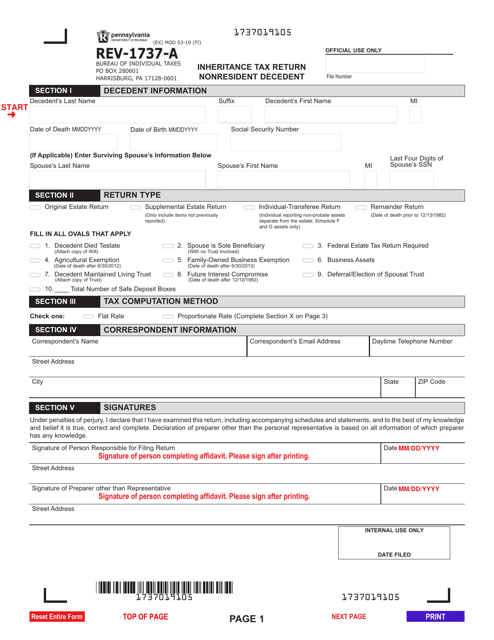

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Form Rev 1737 A Download Fillable Pdf Or Fill Online Inheritance Tax Return Nonresident Decedent Pennsylvania Templateroller

The Estate Tax Exemption Is Adjusted For Inflation Every Year

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Inheritance Tax Explained

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

Pennsylvania Inheritance Tax Agriculture Family Business Exemptions